nebraska inheritance tax rates

Nebraska inheritance tax is computed on the fair market value. Currently the first 15000 of the inheritance is not taxed.

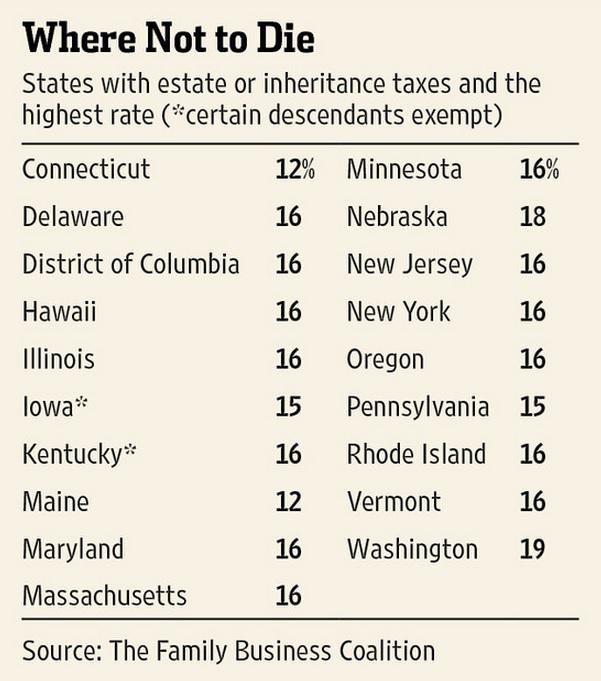

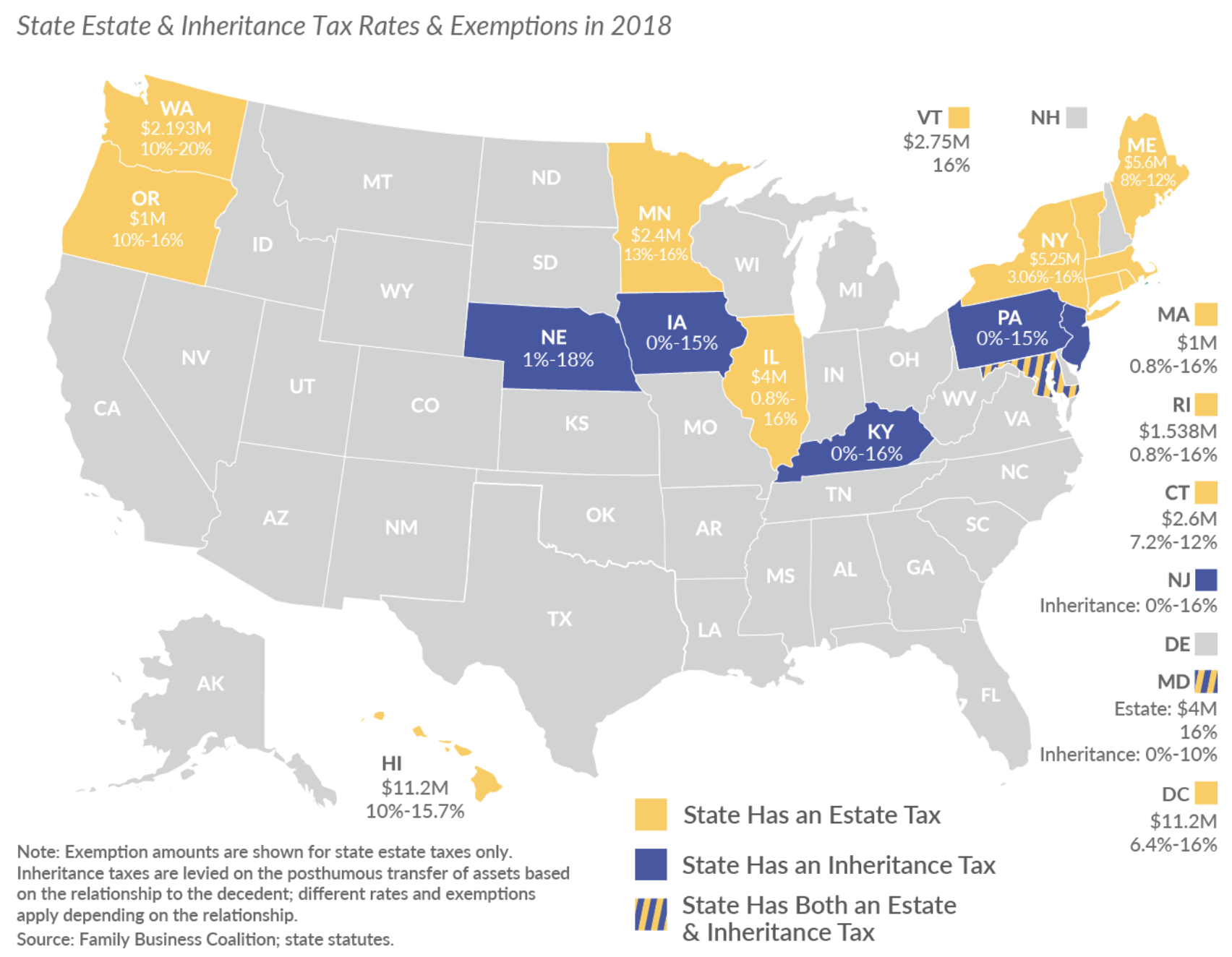

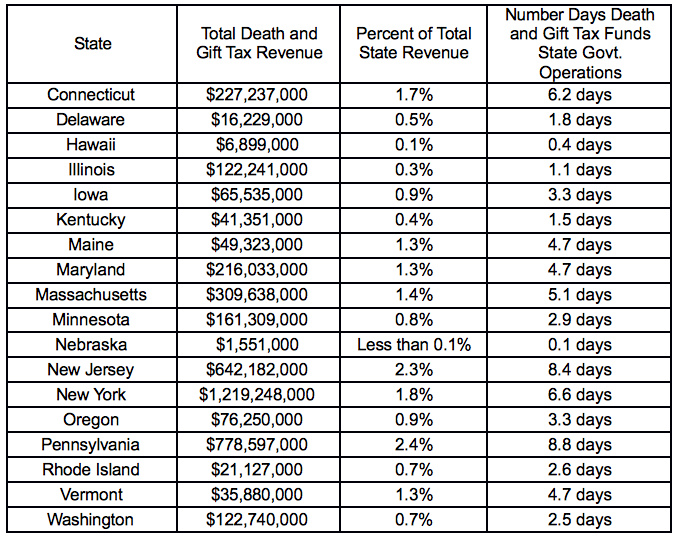

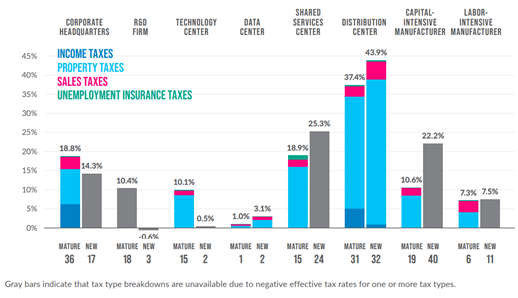

The Death Tax Taxes On Death American Legislative Exchange Council

Of the six states that currently impose inheritance taxes only two states Nebraska and Pennsylvania have chosen to tax lineal heirs children and grandchildren while the others exempt these relatives.

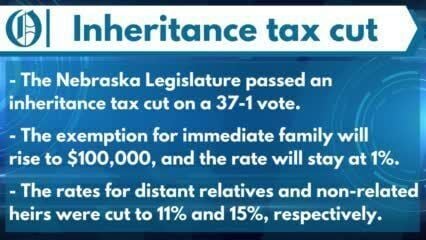

. However on February 17 2022 Nebraska Governor Pete Ricketts signed a bill into law effectively reducing the inheritance tax for deaths occurring on or after January 1 2023. For transfers to unrelated persons the inheritance tax rate is 18 on transfers over a 10000 exemption amount. Anything above 15000 in value is subject to a 13 inheritance tax.

Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs6. REG-17-001 Scope Application and Valuations. Nebraska is currently one of six states that imposes an inheritance tax when a resident of the state passes away.

Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount which ranges between 10000 and 40000. 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests. This 1 rate applies to children.

Who are the remaining persons receiving inheritances. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. That exemption amount and the underlying inheritance tax rate varies based on the inheritance.

For transfers to immediate family members not including spouses the inheritance tax rate is 1 on the value of the property that passes to each person over an exemption amount of 40000 per person. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023. How is this changed by LB310.

Nebraska Legislature Passes Inheritance Tax Cut Journalstar Com

Nebraska Inheritance Tax Updates Erickson Sederstrom

Feeling The Squeeze The Negative Effects Of Eliminating Nebraska S Inheritance Tax Open Sky Policy Institute

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

What Is An Inheritance Tax 2021 Robinhood

Inheritance Tax 2022 Casaplorer

Nebraska Legislature Passes Inheritance Tax Cut Journalstar Com

Don T Die In Nebraska How The County Inheritance Tax Works

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Nebraska Legislature Passes Inheritance Tax Cut Journalstar Com

Worst States For Retirement For 2018 New Tax Law Takes Its Toll Topretirements

The Death Tax Taxes On Death American Legislative Exchange Council

5 Essential Steps To Reform Taxes In Nebraska

Don T Die In Nebraska How The County Inheritance Tax Works

States You Shouldn T Be Caught Dead In Wsj

Bill To Cut Inheritance Tax Rates Increase Exemptions Advanced Unicameral Update